Miya Bholat

Miya Bholat

Jan 16, 2026

What Is Fleet Insurance? Coverage Types, Costs & How to Choose

Key Takeaways

- Fleet insurance simplifies coverage for businesses operating multiple vehicles. Bundling vehicles under one policy reduces administrative burden and improves consistency.

- Coverage should match how your vehicles are used, not just what you own. Liability, physical damage, and optional endorsements should reflect real operational risks.

- Insurance costs are directly influenced by safety, maintenance, and claims history. Better data and proactive management lead to more favorable premiums over time.

- Fleet and non-owned auto insurance often work together. Both are necessary when employees drive company and personal vehicles for work.

- Fleet management software supports better insurance outcomes. Maintenance tracking, inspections, and telematics help reduce claims and demonstrate risk control.

- Choosing the right policy requires more than price comparison. The best fleet insurance aligns coverage, service, and flexibility with long-term business goals.

What Is Fleet Insurance?

Fleet insurance is a type of commercial auto insurance policy that covers multiple vehicles under a single plan. Instead of insuring each vehicle individually, businesses insure their entire fleet together, which simplifies administration and often reduces overall costs. Fleet insurance typically applies when a business operates two to five or more vehicles, depending on the insurer, and becomes increasingly valuable as the fleet grows.

Unlike individual commercial auto policies that focus on one vehicle at a time, fleet insurance treats vehicles as part of a group. This allows businesses to add or remove vehicles without rewriting multiple policies, adjust coverage consistently across the fleet, and manage renewals more efficiently. For companies with delivery vans, service trucks, sales vehicles, or specialized equipment, this centralized approach saves time and reduces risk gaps.

Most businesses consider fleet insurance once vehicle usage becomes frequent, shared among multiple drivers, or essential to daily operations. Construction companies, utilities, government agencies, and service-based businesses commonly rely on fleet policies because vehicle downtime or uncovered claims can directly impact revenue and safety.

Types of Fleet Insurance Coverage

Fleet insurance policies are modular, meaning businesses can tailor coverage to match how vehicles are used. Understanding the core coverage types helps fleet managers avoid overpaying while still protecting against major risks.

Liability Coverage – bodily injury and property damage

Liability coverage is the foundation of any fleet insurance policy and is required by law in most jurisdictions. It covers bodily injury and property damage caused to others when a fleet vehicle is involved in an at-fault accident. This includes medical expenses, legal fees, and repair costs for third-party property.

For fleets, liability exposure increases with mileage, driver count, and urban driving environments. A single serious accident involving a truck or van can easily exceed six figures in claims, which is why higher liability limits are common for fleets. Insurers closely evaluate driver training, safety policies, and past claims when pricing this coverage.

Physical Damage Coverage – collision and comprehensive

Physical damage coverage protects the fleet’s own vehicles. Collision coverage pays for repairs or replacement if a vehicle is damaged in an accident, regardless of fault. Comprehensive coverage handles non-collision events such as theft, vandalism, fire, hail, or falling objects.

This coverage is especially important for newer or high-value vehicles. Fleets with financed or leased vehicles are often required to carry physical damage coverage. Older fleets may choose higher deductibles to control premiums while still protecting against catastrophic losses.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage protects your drivers and vehicles when another party causes an accident but lacks sufficient insurance. Despite legal requirements, many drivers carry minimal coverage or none at all.

For fleets operating in high-traffic or urban areas, this coverage helps prevent costly out-of-pocket expenses and legal disputes. It ensures medical bills and vehicle repairs don’t fall entirely on the business when the other driver cannot pay.

Additional Coverage Options – cargo, rental reimbursement, roadside assistance, etc.

Beyond core coverage, fleets often add specialized options based on operational needs. These endorsements address risks that standard policies don’t fully cover, including:

- Cargo insurance to protect goods or equipment being transported

- Rental reimbursement to keep operations moving while vehicles are repaired

- Roadside assistance for breakdowns, towing, and lockouts

- Hired and non-owned auto coverage for employee-owned vehicles used for work

- Gap coverage for financed vehicles with outstanding balances

These add-ons are particularly valuable for delivery fleets, contractors, and service businesses where delays directly affect customers and revenue.

How Fleet Insurance Differs from Individual Policies

Fleet insurance differs from individual commercial auto policies in both structure and intent. The biggest difference is centralized management. Fleet policies allow businesses to manage coverage, renewals, and vehicle changes in one place rather than juggling multiple contracts.

Pricing also works differently. Instead of pricing each vehicle in isolation, insurers assess the fleet as a whole, factoring in total mileage, driver behavior, vehicle mix, and claims history. This pooled risk often results in lower per-vehicle premiums, especially for larger fleets with strong safety records.

Fleet policies also offer greater coverage flexibility. Businesses can standardize limits, deductibles, and endorsements across all vehicles, reducing the chance of coverage gaps. Administrative efficiency improves as well, since adding a new vehicle or retiring an old one doesn’t require starting from scratch.

What Affects Fleet Insurance Costs?

Fleet insurance premiums are calculated using a mix of vehicle, driver, and operational data. Insurers want to understand how likely a claim is and how severe it could be.

Vehicle Types and Values

The type, age, and value of vehicles play a major role in pricing. Heavy-duty trucks, specialized equipment, and newer vehicles typically cost more to insure due to higher repair and replacement costs. Safety features such as collision avoidance systems or dash cameras can help offset some of this risk.

Driver Records and Safety History

Drivers are one of the biggest risk factors. Insurers review motor vehicle records, accident history, and violations across the fleet. A pattern of speeding tickets or at-fault accidents will drive premiums up, while clean records and documented training programs can lower rates.

Industry and Usage Patterns

How vehicles are used matters just as much as what they are. Long-haul driving, urban delivery routes, night driving, or hazardous materials transport all increase exposure. Insurers also consider average mileage and whether vehicles operate across state lines.

Claims History and Loss Ratios

Past claims strongly influence future premiums. Insurers look at loss ratios to determine whether a fleet generates more claims than average. Fleets that proactively reduce incidents through maintenance, inspections, and driver coaching often see more favorable renewals over time.

Fleet Insurance vs. Non-Owned Auto Insurance

Fleet insurance and non-owned auto insurance serve different purposes, and many businesses need both. Fleet insurance covers vehicles owned, leased, or titled to the business. Non-owned auto insurance covers liability when employees use personal vehicles for work-related tasks.

For example, a company with a fleet of service vans may also reimburse employees for using their own cars for sales visits. In that case, fleet insurance protects the vans, while non-owned auto insurance fills the liability gap for personal vehicles. Together, they provide comprehensive protection across all driving scenarios.

How to Choose Fleet Insurance for Your Business

Choosing the right fleet insurance starts with understanding your actual risk profile. Fleet managers should evaluate vehicle count, usage patterns, driver roles, and regulatory requirements before requesting quotes. Working with an experienced broker can help identify coverage gaps and negotiate better terms.

When comparing policies, focus on more than just price. Review liability limits, deductibles, exclusions, and endorsements carefully. Ask how claims are handled, how quickly vehicles can be added or removed, and whether discounts apply for safety programs or technology adoption.

A practical approach includes:

- Reviewing current vehicle inventory and planned growth

- Assessing driver training and safety documentation

- Comparing claims support and insurer responsiveness

- Ensuring coverage aligns with contracts or regulatory needs

These steps help ensure the policy supports operations rather than creating friction.

How Fleet Management Software Impacts Insurance

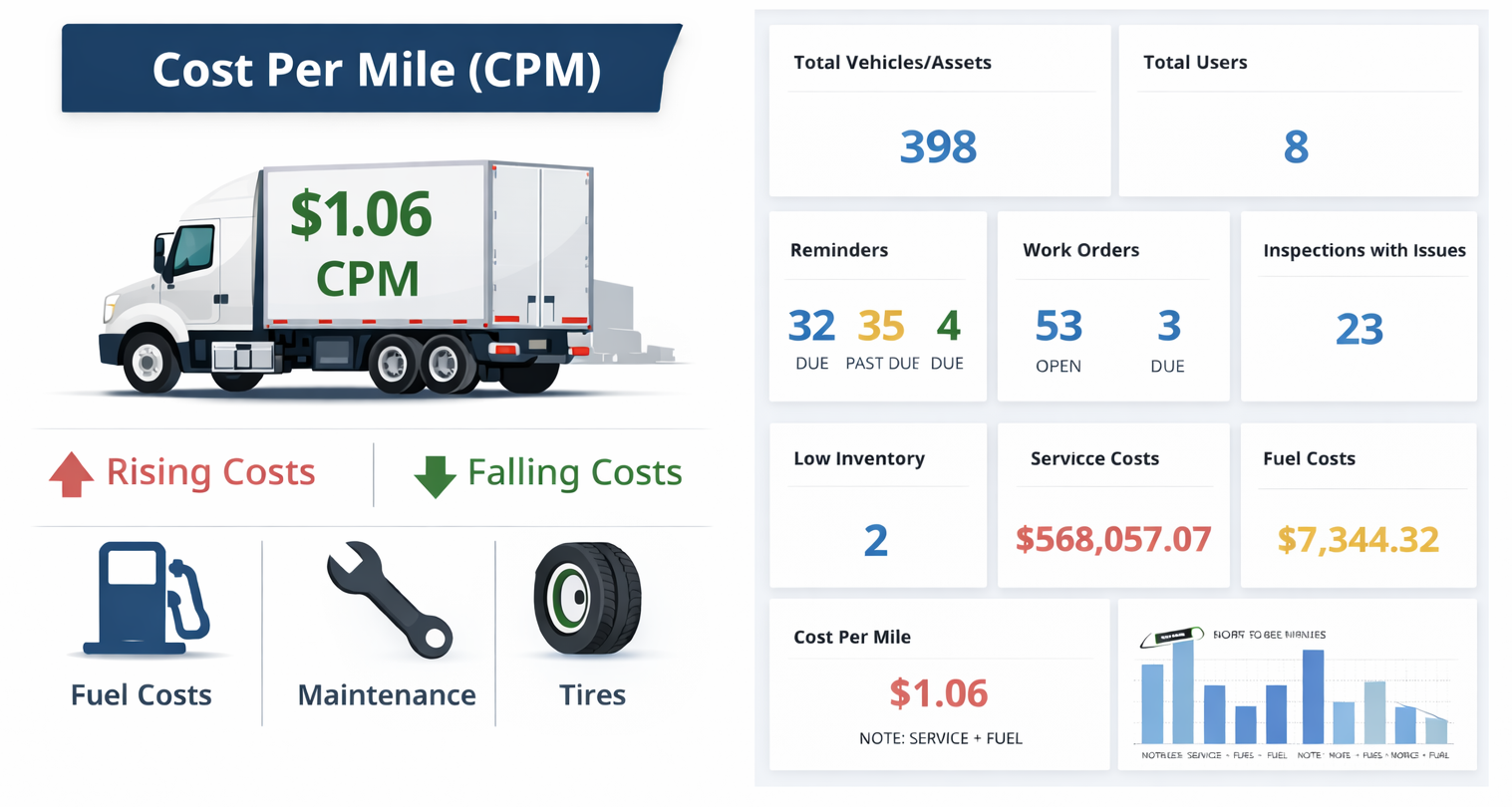

Fleet management software plays an increasingly important role in insurance outcomes. Insurers favor fleets that can demonstrate proactive risk management through data and documentation. Tools that track maintenance, inspections, and driver behavior reduce accidents and claims over time.

For example, preventive maintenance tracking helps ensure vehicles stay roadworthy, reducing breakdown-related accidents. Digital inspections create a verifiable record of vehicle condition, which can support claims defense and compliance efforts. Many insurers also recognize the value of GPS and telematics data in improving driver accountability and route safety.

Platforms like AUTOsist support these efforts by centralizing maintenance records, inspections, and vehicle history in one system. When combined with GPS and telematics integrations, fleets gain visibility into usage patterns that insurers increasingly reward. This ties closely with broader risk strategies discussed in resources like Fleet Risk Management: Your Complete Guide to Improve Fleet Operations and operational tools such as Fleet GPS Tracking Software and Digital Vehicle Inspection Apps.